Project Nexus: The Next Leap for Global Instant Payments

Instant, Low-Cost Remittances. Say Goodbye to High Fees and Long Waits!

Project Nexus represents a fundamental shift in the way people transfer money overseas. This initiative aims to link global instant payment systems (for example, UPI in India and PayNow in Singapore) together to facilitate cross-border transfers. The initial list of participating countries includes India, the Philippines, Malaysia, Singapore, and Thailand. Nexus will enable users to transfer funds across borders, to achieve the United Nations Sustainable Development Goal (SDG) target of 3% cross-border costs - a significant reduction from the current average of 6% - while slashing settlement time from days to minutes.

🌎 Mumbai to Manila: A Money Transfer Story

Rahul is a software engineer based in Bangalore. He has a daughter, Puja, who is about to start university in Manila. He wants to transfer some money for her monthly living expenses. He goes to his online banking portal, keys in INR 50,000, fills in all the beneficiary account details, and proceeds to the confirmation page. Only now does he notice multiple layers of fees added to his amount, and the total cost for the transfer is roughly INR 4,660. Let’s break down how we came across this number:

The Indian bank’s fee (sender) + GST: INR 1,180.

Correspondent Indian bank charges (which are intermediary banks that facilitate cross-border payments, particularly when the sending and receiving banks lack a direct relationship): INR 2,133.

The Philippine bank’s (recipient) fee: INR 227 (Ph 150).

FX margin (typically charged by the sending bank): INR 1,120 (2.4%).

This represents roughly 9.3% of the cost of sending funds across ASEAN countries.

Additionally, it often takes over 4-5 days for Rahul’s daughter to see the funds reflected in her account.

⛓️💥 Rahul’s story reflects a much larger issue: a global system riddled with inefficiencies.

💀 The Broken Promise of Global Payments

In 2024, roughly $194 trillion was transacted through cross-border payment rails, with this expected to reach upwards of $300 trillion in the next 8 years.

The global average cost of payments is roughly 6.6% for sending $200 across borders, which is significantly higher than the UN SDG target of achieving an average cost of roughly 3%. This represents a big pain point for the expatriate population of the world, who frequently remit money to their loved ones back home.

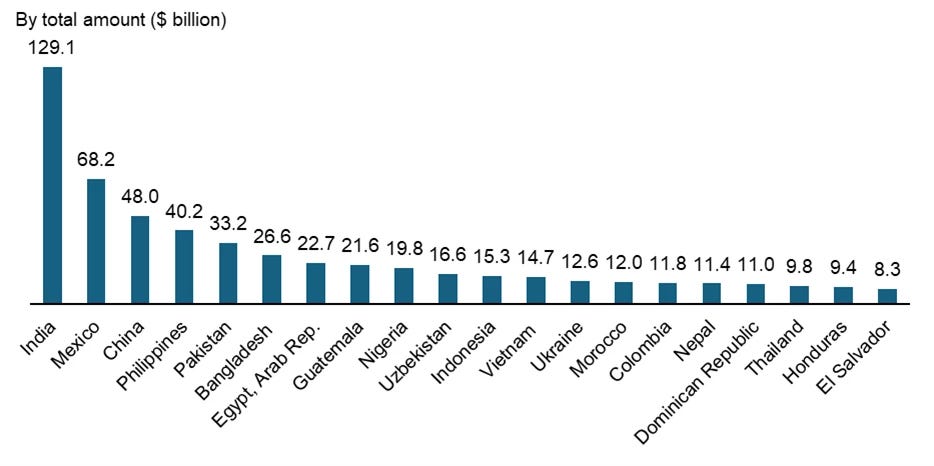

The following countries see the largest inflow of cross-border payments in 2024:

Expats sending money back home can unfortunately expect the following:

Average cost of payments ~ 6.3%

Average settlement time: 1-5 days

Converging to the United Nations SDG goal will free up 3.3% of remitted funds and increase the funds available to recipient families. This is especially important as studies suggest that a 10% increase in remitted capital can lead to a 3.5% decline in poverty, and unlocking that 3.3% will go a long way in making that happen. This is precisely the challenge a global initiative needs to address.

🗽 Enter Project Nexus

5 major ASEAN players have decided to come together to solve this broken system. Project Nexus, in a nutshell, aims to closely integrate domestic payment systems to ensure that cross-border payments can flow between borders with ease and simplicity.

Over 60 countries today have domestic payment systems that are mature, meaning residents can transact domestically with a near-zero cost and see funds reflected in the recipient account within 60 seconds. Now, each system works within its domestic ecosystem, but they are all built using different manuals. To create a global initiative all systems would need to speak the same language.

Project Nexus aims to establish a central communication protocol for domestic payment networks to expose their IPS systems to send/receive global remittances. This would remove the need for participant countries to individually establish bilateral connections with other participants.

In April 2025, 5 central banks incorporated Nexus Global Payments in Singapore as a not-for-profit organization, but the journey to get here was not easy. Nexus was started in 2021 as an experimental project. Let’s now take a closer look under the hood at how Nexus works.

⚙️ The Tech Stack

Project Nexus will deploy a distributed network of ‘Nexus Gateways’ instead of all countries connecting to the centralized system. Each participating country will deploy and manage its own ‘Nexus Gateway’, which will act as the bridge between the domestic payment network and the global ecosystem through the Nexus communication protocol. This distributed cloud architecture can effectively address a major scalability issue. Rather than overloading a central server with billions of transactions, each country’s gateway handles the workload for its domestic payment activities and coordinates with other gateways through standardized APIs and the ISO 20022 messaging format

The ISO 20022 messaging format will be the cornerstone of ensuring that this communication protocol can be successfully implemented. Participant countries will be required to ensure that their IPS networks are capable of communicating through this messaging format, as each Nexus Gateway is designed to process messages in this format. To ensure a successful rollout, Nexus began with countries that already lead in payment innovation.

🏦 The Starting 5: Asia’s Payment Powerhouses

It makes sense that when it came time to select the pilot countries, BIS wanted participant countries that have the strongest track record for domestic IPS implementation. The starting 5 countries have designed and manage the most successful IPS systems in the world

India’s UPI: The MVP of the squad, India’s UPI processes roughly 602 million transactions in a day on average. On average, UPI processes roughly 1 out of 2 global real-time payments, capturing roughly 49% of the global real-time payments market.

Thailand’s PromptPay: Boasts over 81 million registered accounts as of March 2025. Very similar to India’s UPI implementation, the platform allows users to make domestic payments through nationally recognized ID numbers or by scanning QR codes.

Singapore’s PayNow: PayNow has seen tremendous adoption amongst residents and businesses, with over 80% adoption being reported in the country.

Malaysia’s DuitNow: DuitNow is quickly emerging as the leading network for QR adoption, with 64% lagging only behind China. DuitNow is also an excellent case study of implementing QR-based payments across borders. Travelers from Indonesia, Singapore, and Thailand can make payments by scanning the DuitNow QR code via their banking applications.

Philippines’s InstaPay: 56% of the adult population use e-money accounts that plug into the InstaPay network and payment rails. As of 2024, InstaPay handles roughly 1.5 billion transactions in a year.

Additionally, Singapore and Thailand pioneered the first bilateral, cross-border IPS system connection in 2021. They offered a proven case study in implementing real-time payments across borders, where transactions only require knowing the national ID/ phone number of the participating parties. As of 2022, this corridor was processing more than 65,000 transactions on a monthly basis with an average cost of payment around 3.4%. With these foundations in place, the next phase is truly transformative.

🚀 A New Era of Fast, Cheap, and Transparent Cross-Border Payments

The world is on the brink of a major financial breakthrough- linking Instant Payment Systems (IPS) across borders in over 60 countries. The G20 and global financial bodies like the FSB and CPMI have made this a top priority. By 2026, Project Nexus is set to transform cross-border transactions, improving payment efficiency and deepening global economic integration.

💡 The Nexus Advantage

Unlike a complex, one-off bilateral link, Project Nexus simplifies everything:

🔗 Provides instant access to all other IPS networks: A single integration offers instant connectivity to every country on the Nexus network without any need for multiple, costly links.

🧩 Reduces integration efforts by over 95% (from 1,770 projects to just 60!): Instead of building hundreds of individual connections, countries would only need to link once to Nexus, massively reducing technical and legal overhead.

💸 Ensures full transparency with real-time fee and FX-rate visibility: Users can view the exact cost, exchange rate, and delivery time without any hidden deductions or unclear settlement timelines.

🔐 Designed for the Digital Era

Project Nexus could redefine global remittances, making payments faster, cheaper, safer, and universally accessible, with its set of design principles:

⏱️ Payments complete in 60 seconds or less

Thanks to 24/7 instant processing, cross-border transactions can move as fast as domestic ones.

🛡️ Lower costs, fewer intermediaries, and greater security & resilience

Nexus can reduce reliance on traditional correspondent banking, cutting costs and enhancing financial system stability.

🧑💼 Uses familiar IDs like phone numbers for easy access

Senders can pay using everyday identifiers like mobile numbers or email addresses instead of long IBANs.

👨👧 For Rahul? With Nexus, he can send INR 50,000 to his daughter, Puja, in Manila in minutes, paying only 3% instead of 9.3%, and ensuring the funds arrive on time.

Want a quick visual summary of ‘Project Nexus’? Check out a video explainer linked in the comments! 🎦

💬We’d love to hear from you!

Have thoughts on cross-border payments, or ideas for topics you'd like us to cover next? Drop a comment below or mail us at cashandcache@gmail.com📨

Woah that's something new information thanks

Check out this brief explainer on how 'Project Nexus' could revolutionize instant payments:

👉https://youtu.be/9QJBePGwRdg